nj tax sale certificate foreclosure

Most of us are familiar with the traditional property. Sales subject to current taxes.

Princeton Office Park LP.

. Sale of certificate of tax sale liens by municipality. Ad Get Access to the Largest Online Library of Legal Forms for Any State. 2 Get a resale certificate fast.

Tax Sales Certificates. The purpose of the tax. Title Practice 10117 4th Ed.

At the conclusion of a property tax certificate. If the tax lien certificate is redeemed by the delinquent property owner. Purchasers of tax sale certificates liens.

Sale of certificate of tax sale liens. Tax Sale Certificate Redemption Purpose The purpose is to discharge an original Tax Sale Certificate. If foreclosure is completed a final judgement is then entered and the property belongs to the lien holder who can then take possession of the property.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. Ad Download Or Email NJ CN 10169 More Fillable Forms Register and Subscribe Now. This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders.

New Jersey law requires all 565 municipalities to hold at least one tax sale per year if the municipality has delinquent property taxes andor municipal charges. This is a Court Sample and NOT a blank form. The purpose of the tax.

Yes Unlike Mortgage Foreclosure in most cases proceedings to foreclose a tax sale certificate are not followed by a public. The bottom line was that the Chancery Division. 0024-0000 Tax Sale Certificates Copy and Register---A tax sale certificate is a recorded lien against the property for an outstanding levy.

The New Jersey Supreme Court in In re. An NJ Tax Sale Certificate foreclosure is different than an NJ bank loan Foreclosure. Court samples are copies of.

This was an action to foreclose a tax sale certificate. New Jersey law requires all 565 municipalities to hold at least one tax sale per year if the municipality has delinquent property taxes andor municipal charges. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the.

The Plaintiff in a tax sale foreclosure. What is sold is a tax sale certificate a lien on the property. This law requires that the almost 600 townsmunicipalities in New Jersey hold annual sales of.

A Tax Sale Certificate foreclosure is different than a bank loan Foreclosure. Tax sale certificates can earn interest of up to 18 per cent depending on the winning percentage bid at the auction. By Wells Jaworksi Liebman LLP on January 1 2001 in Archive.

Are Tax Sale Foreclosures and Mortgage Foreclosures Different. Ad 1 Fill out a simple application. In New Jersey a tax foreclosure is a strict foreclosure meaning that judgment vests title directly to the holder of the tax lien.

Up to 25 cash back In New Jersey once a tax lien is on your home the collector on behalf of the municipality can then sell the property at a public auction subject to your right of. If the certificate is redeemed by the property owner prior to foreclosure the certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the. The sequence of procedural events was somewhat out of order.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. If the certificate is redeemed by.

Once registered you must display your Certificate. Description - New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant. Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent.

As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. As mentioned earlier NJ Tax Sale Certificate foreclosures are based on a complicated process as defined in the New Jersey Tax Sale Law NJSA. Redemption of tax sale certificates TSCs can present difficulties for buyers and sellers as well as for their attorneys and title companiesNJ.

545-1 to -137 a.

Keeping Your Home After A Nj Tax Foreclosure Sale

Nj Tax Lien Foreclosure Attorneys

Otc Tax Liens How We Made 6 In Less Than 120 Days With Tax Liens

Tax Lien And Tax Deed Investments Exec Summary

New Jersey Complaint Condominium Lien Foreclosure Nj Foreclosure Us Legal Forms

Nj Tax Sale Foreclosure Attorneys Residential Commercial

Plaintiff Defendant And Judge How Some Ohio Counties Entrust The Same Officials To Collect Taxes Wipe Liens Wkbn Com

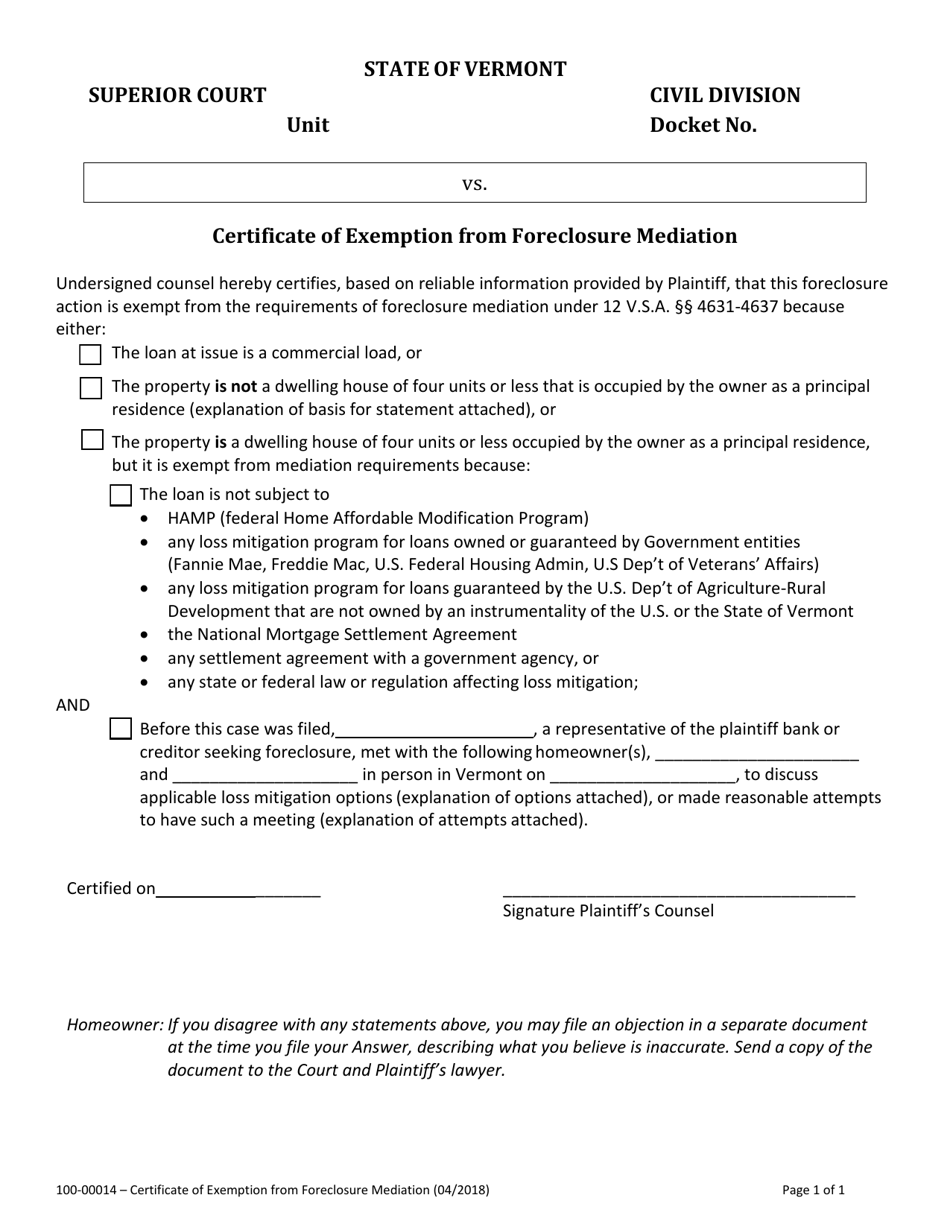

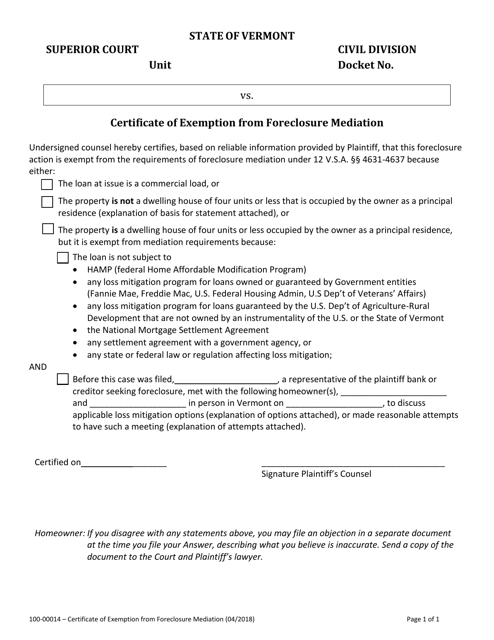

Form 100 00014 Download Fillable Pdf Or Fill Online Certificate Of Exemption From Foreclosure Mediation Vermont Templateroller

Nj S New Amendment To Tax Foreclosure Law More Harm Than Good

New Jersey Complaint For Foreclosure Commercial Nj Foreclosure Us Legal Forms

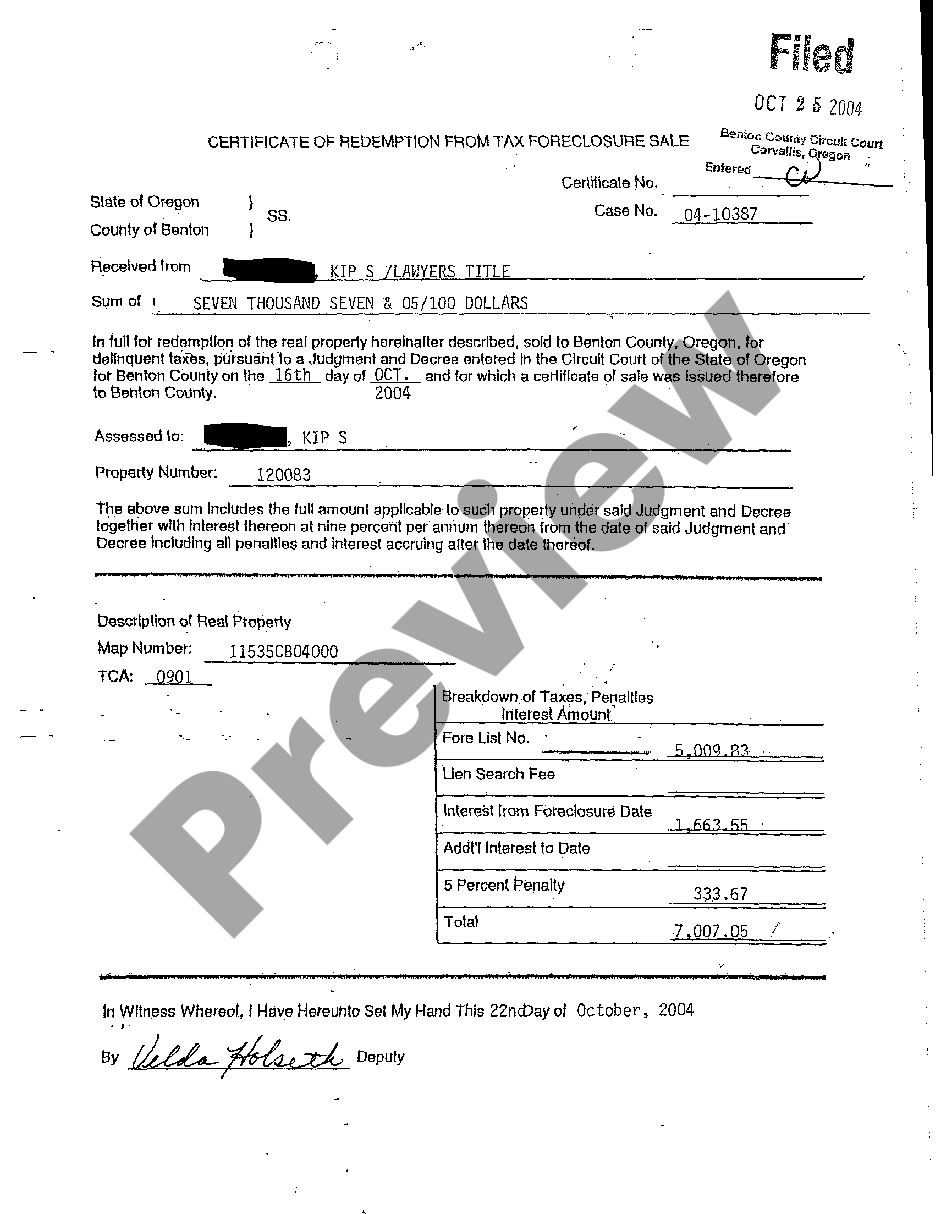

Oregon Certificate Of Redemption From Tax Foreclosure Sale Us Legal Forms

Understanding Nj Tax Lien Foreclosure Westmarq

Form 100 00014 Download Fillable Pdf Or Fill Online Certificate Of Exemption From Foreclosure Mediation Vermont Templateroller

Understanding Nj Tax Lien Foreclosure Westmarq

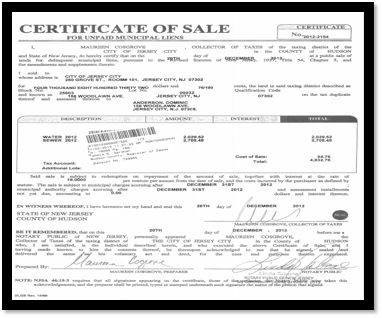

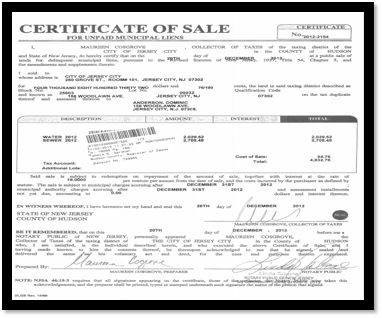

New Jersey Certificate Of Sale For Unpaid Municipal Liens Certificate Of Sale For Unpaid Municipal Liens Us Legal Forms

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense